Investing for retirement

How advisers can help clients prepare for later life

Planning for retirement is one of the main tasks that an adviser will get involved with, and it is one of the main areas they can make a real difference.

But how do they tailor each plan to each client?

Twenty years away from retirement is when most people start to seriously assess where they have got to with their retirement saving.

It is also when clients can make the most significant tweaks to their pensions savings if they think they are likely to go off track.

Many advisers think clients should remain firmly invested in equities, as they still have a long way to run, and equities deliver the best returns.

In this report, we look at the issues facing financial advisers and how they can go about making the right decisions for their clients.

Advisers have said the biggest worry for clients already saving and planning for their retirement two decades from now was running out of savings.

FTAdviser's latest Talking Point poll asked advisers to choose which of the four risks clients who are 20 years away from retirement but already saving for it worry about the most.

A total of 72 per cent, as at July 12, said their clients’ biggest concern was living longer than their pension savings would last.

But 10 per cent said clients worried about having enough to fund social care and another 10 per cent said they were most concerned about passing on wealth.

Meanwhile, some 8 per cent said clients’ biggest fear was having enough to spend on luxuries when they retired, suggesting clients also worry about the quality of life they will be able to afford in retirement.

Ricky Chan, director and chartered financial planner at IFS Wealth & Pensions, said he was not surprised by the results.

He said: "If we were to assume the average retirement age of mid-60s, then clients that are 20 years away would be in their mid-40s.

"It’s usually around this age when clients do start to become more concerned about their retirement planning as they have sorted most of their previous needs and priorities out – like getting onto the property ladder, childcare costs – and now may have higher disposable incomes."

He added: "Or they could have been self-employed/a business owner who chose to reinvest in their business in the earlier years.

"Commonly, they have neglected the retirement planning part for a while and it’s always been on their mind to revisit this to ensure they have enough savings in place for their retirement."

Mr Chan said: "I don’t expect clients to have serious concerns about funding for social care or passing on wealth until a little later in life."

Patrick Connolly, head of communications at Chase de Vere, pointed out that most clients who are 20 years from retirement will not have defined benefit pension schemes.

He said: "So, other than the state pension, they will be relying on the money they’ve saved up and favourable investment performance to provide for themselves in retirement.

"This is just one of many reasons why those planning for retirement should be taking independent financial advice."

How advisers can help clients prepare for later life

Words Fiona Nicolson

Images: Fotoware

Preparing for later life is important, but sometimes people let it slip.

They know they want a comfortable retirement, but all too often, planning stays on the back burner.

There are many reasons why. Clients in their 40s, for instance, may be providing financial support to children – and to parents.

And this is unlikely to change; recent research by St. James’s Place revealed that a quarter of future retirees expect to still be helping out family members.

But if clients wish to sustain their current standard of living and also have enough money to enjoy their retirement, planning and saving is vital.

Otherwise, there could be trouble ahead, as Andrew Bailey, chief executive of the Financial Conduct Authority said at the regulator’s annual public meeting in July: “The combination of increasing life expectancies with continued low interest rates and the difficulty of building up savings for older age has the potential to create a serious challenge for consumers’ finances in the next stage of their lives.”

People therefore need help to prepare for later life, and advice puts them in a better position to do so, according to St. James’s Place.

Advice has an important role to play in ensuring a comfortable and confident financial future

As Claire Trott, head of pensions strategy, says: “Our research found that eight in 10 people who receive ongoing face-to-face advice believe they have sufficient funds to fulfil their retirement plans.

“This compares with only 35 per cent who don’t receive advice. It’s clear advice has an important role to play in ensuring a comfortable and confident financial future.”

So, what can advisers do, to help clients navigate the challenges?

Serious discussions − and putting the client at ease

The ‘sandwich generation’ is not just concerned about supporting the generation above and the one below – it has other worries, as adviser Carl Lamb of Almary Green in Norwich points out.

He says: “Clients are worried about Brexit and the economy, and are looking to reduce debt, which is having an impact on their pension savings.”

Advisers are often therefore starting from a position where clients have many demands on their money and affordability is key.

So, what is the best way to move forward? Providing information and enhancing their knowledge, according to Mr. Lamb, who says: “How advisers can help clients prepare for later life can be summed up in one word – education.”

Frank Morton of Phil Anderson Financial Services in Aberdeen agrees: “Our principal job as advisers is to educate people about money, and what they can and can’t do, and to help people overcome their fears around making financial decisions.”

Education is also the focus for Mark Insley of Ascot Wealth Management, in Berkshire who sums up what is needed: “We help educate the client on the best way to draw an income in retirement, in the most tax-efficient manner.”

While facts and figures are of course crucial, they are not always clients’ main focus, as Mr. Morton says: “It’s about tuning into the individual’s way of thinking about money. Clients tell us they would rather have confidence and peace of mind from their financial decisions than information on the growth of their investments.”

Jeannie Boyle of EQ Investors in London believes in an approach which motivates clients to visualise later life, as she explains: “One of the difficult things for clients, when planning for retirement, is how they bridge the gap between ‘me now’ and ‘me in the future’. They need to get a sense of their ‘future self’.

The next step is to generate enthusiasm for this stage of their life, as she adds: “Advisers can of course help with the cashflow modelling, but we can also get clients excited about retiring. Getting them to articulate the life they want in the future creates an urgency for saving for it.”

Retirement planning considerations

The practicalities of helping clients prepare for later life involves looking at a number of important factors such as the current status of their pension savings, identifying other assets they have, looking at projections of their current pension savings, and many other granular, financial details, as Mark Insley of Ascot Wealth Management in Berkshire points out.

He says: “When advising the client, you need to also find out the client's employment status; the value of their current pension contributions; whether they are eligible for their company's auto-enrolment scheme; whether their current investments are in a tax-efficient wrapper at present; what debt they have, in the form of mortgage, vehicles, credit cards and loans, and what the repayments are; what the client's targeted retirement income is; whether they are approaching their lifetime allowance; and what their family situation is, as well as looking at inheritance tax.

“This is not a finite list, though,” he emphasises.

Advisers can also potentially help clients boost their pension pot by tracking down old company pensions.

And the results can be well worth the effort, as Mr. Insley explains: “There are more than 1.6m pension pots worth £19.4bn that are currently lost.

“This equates to roughly £13,000 per plan.”

While advisers are tasked with the job of obtaining all the necessary financial information and proposing solutions, clients have an obligation too.

People need to think about what they are prepared to give up today, to pay for tomorrow

As Mr Lamb says: “It is important that people take their retirement planning seriously. They need to think about what they are prepared to give up today, to pay for tomorrow.”

Mr Morton takes a similar approach: “We ask clients to tell us about their lifestyle and what they are prepared to sacrifice to reach their retirement goals.”

He also believes attitude to spending is an important point to cover: “A lot of the discussion is around whether they are frugal or extravagant, and whether they spend more than they save.”

One of the other ways that Mr Morton helps clients prepare for later life is by making use of US financial planning ‘guru’, George Kinder’s ‘three questions’, as he explains: “We ask clients to identify their lifestyle preferences, including how they would live their life if they were financially secure; how they would live if they only had five to 10 years left; and how they would feel if they only had 24 hours left to live, and if they’d change anything.”

He also uses a mnemonic, called ‘CRAFT’, which he says the company uses as a guideline for providing investment advice.

It focuses on putting the client first; the risks attached to investment; asset allocation and the importance of diversification; the funds in each asset class; and tax implications.

Mr. Morton also factors in generational changes, as he observes: “Clients often tell us that their generation was not as dependent on their parents as today’s.

“The landscape of life planning is very different from what it was a generation ago.”

Constructing the retirement portfolio

When it comes to constructing retirement portfolios for those who are 20 years away from retiring, Mr Lamb says: “There is no straightforward answer to this.

“It depends on their attitude to risk. But there needs to be a reasonable amount in equities, to get a decent return.

Mr Morton takes a similar view: “Anyone with 20 years to go before retiring should be fully invested in equities – no question.

“But very few clients tend to be comfortable with that because they see volatility if they’re watching the FTSE or the media.”

Reflecting on the disconnect between the facts and figures, and clients’ emotional responses, Mr. Morton adds: “Evidence shows that the more is invested in equities in the long term, the more in the ‘pot’. Equity returns will deliver more than other asset classes.

Anyone with 20 years to go before retiring should be fully invested in equities – no question

“Investing it all in equities is the ‘scientific’ approach, but clients tend not to be able to accommodate this, so instead we would recommend a blended range of diversified asset classes.

“People have to be comfortable with their retirement decisions, and the partnership between adviser and client is crucial.”

Ms. Boyle also reflects on some clients’ reluctance to invest in equities: “It can be difficult for people who are not used to investing; they tend to err on the side of caution.

“Advisers have a part to play in educating clients to focus more on the long-term results of inflation on portfolios, rather than on volatility.

“There is after all the potential for higher growth from equity investing and volatility can be positive.”

Mr Insley shares the view that equities are usually the best bet, as he comments: “With an investment horizon of 20 years, you should be looking for a portfolio that holds a healthy proportion of investments in equities.

“Equity investments are seen to be more risky an investment in comparison to fixed interest or property investments, but over the course of 20 years the investment returns will be higher in equity investments than the latter.”

He adds: “Of course there are considerations to take into account like the risk profile of the client and setting them up with a well-diversified portfolio.”

Summing up, Ms. Boyle recommends three main points for advising clients who have 20 years to go till retirement: “They need to consider the lifestyle they want in the future; take the time to think about how they are going to achieve it; and ‘pay’ themselves first.

“There is lots of pressure on their income and clients can be focused on giving their children a good start in life.

“However, they should put away money for retirement as their first priority, before putting aside money to support the family.”

House View: Are you in control of your finances?

From pensions to savings, every investment brings risk and potential reward.

So, it goes without saying that people want to feel in control of their personal finances.

But are people really taking the best approach when it comes to handling their investments?

We spoke to over 25,000 people, from 32 countries around the world, to explore their behaviours around investing.

Here are our findings in a nutshell.

People lack confidence in exactly how much money they have invested/saved, and where it is.

Only 44 per cent of people are very confident with how much money they have with various financial providers, and this reduces sharply for those with less self-purported investment knowledge.

People are not satisfied with the performance of their investment(s).

Over half (51 per cent) have not achieved what they wanted with their investments over the past five years, and most attribute their own action or inaction as the main cause of this failure.

Globally, there is a clear need to be more patient with investments.

The average holding period before changing or cashing in an investment is 2.6 years, which is just over half the five-year term experts generally recommend to stay invested for.

People have unrealistically high annual return (that is, income and capital growth) expectations.

Investors expect on average a very high 10.7 per cent return per year over the next five years, while one in six expect at least a staggering 20 per cent annual return on their total investment portfolio.

In times of market uncertainty, people make immediate changes to their risk profile.

In the final three months of 2018, when the MSCI World index of global equities fell sharply, only 18 per cent of people kept their investments the same, and a further 9 per cent made changes to their portfolio but kept the risk profile the same.

There is an expectation from people that investments will produce close to the income that they want.

Income expectations for the next 12 months are very high on average (10.3 per cent), which is just under what people want to receive (10.7 per cent).

There is a general home bias for investments, and people are split over the benefit of investing in emerging markets.

As many as 31 per cent of people prefer the majority of their portfolio in funds that invest in their home country, while a further 34 per cent prefer investing in countries familiar to them.

Only 31 per cent of people globally feel emerging markets could be beneficial to their portfolio, and almost a quarter (24 per cent) think it is too risky to do so.

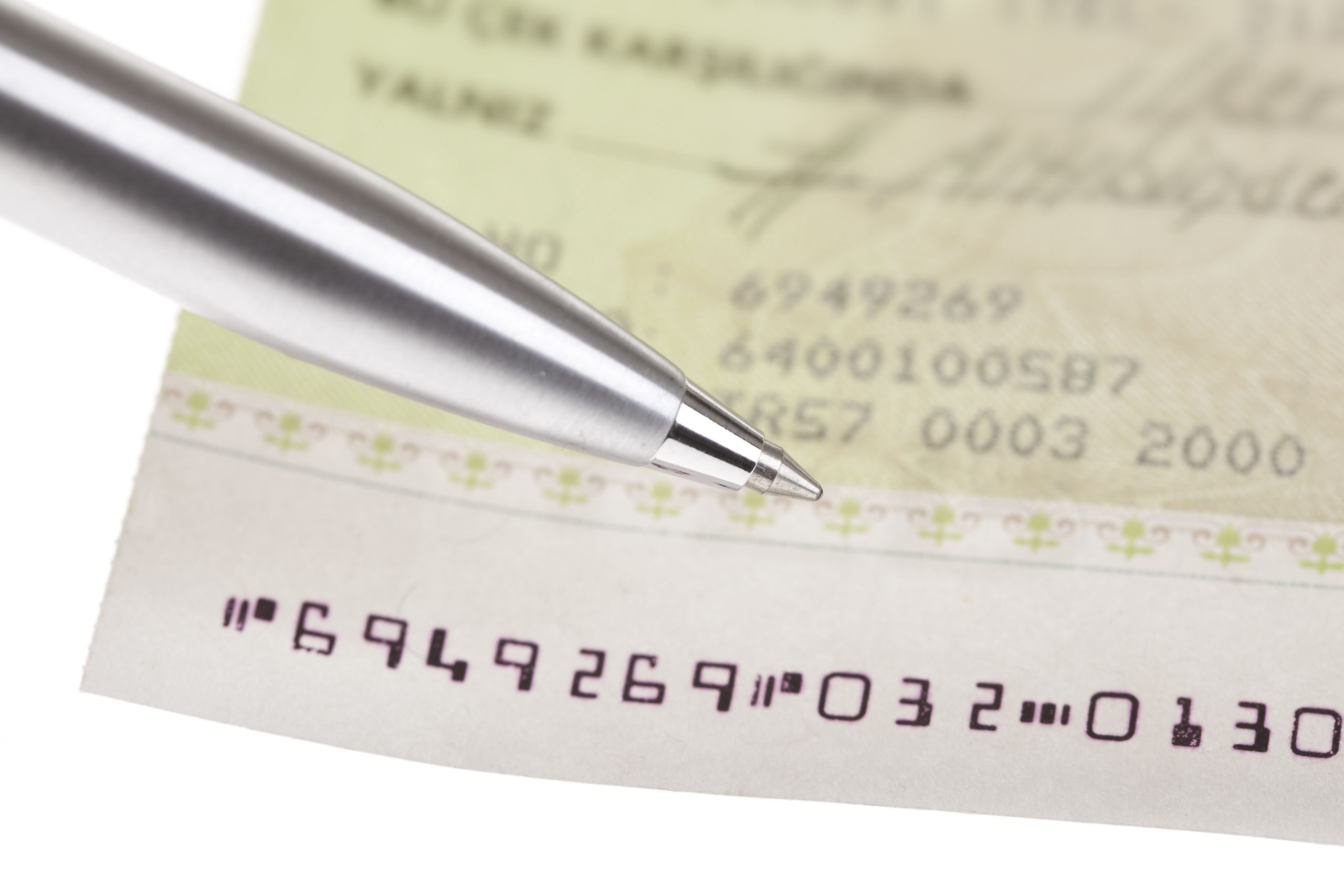

Investment interests differ by age

When looking at the type of investments people held, there is a clear correlation between age and interest in slightly more unique investment types.

Millennials were much more likely to have money invested in cryptocurrencies and crowdfunding (23 per cent and 12 per cent respectively).

This interest in these newer, and riskier, investments is reduced with the older age groups.

Unsurprisingly, some of their attitudes towards risk reflect this, with millennials being the most likely to believe the greatest risk to them is not taking enough risk to achieve their investment objectives (53 per cent).

This trend also reduces with age, to 24 per cent of those aged 71 and over.